Free template: We tried this simple budget approach for our family (including 1 free ready to use money map template)

In our recent post on family financial planning, we introduced three ‘loveactions’ to help families create a simple budget:

- Understand your spending

- Dreamlining

- Making a money plan

These steps might seem overwhelming at first, but in this post, we’ll break them down – including how to use our free, low effort family money map template to win back time and energy from your life admin.

The goal? To understand where your money is currently going and turn your money dreams into achievable goals.

You don’t need to tackle every task together – you can divide and conquer – but it’s important to approach this as a team. Even if you’re not a “numbers person,” the reality is both of you deal with your money daily. Being on the same page about your simple budget is key for everyday life and can reduce money related relationship issues. Emergencies happen too, and both knowing your finances together can make all the difference when life throws something new at you.

Trust me, you can do this! When we first started understanding our spending, setting goals, and creating a simple budget, it felt like ripping off a band aid (which hurts far less since giving birth so maybe not the best example). But the sooner you start, the better. Once you do, it’s empowering and you’ll be able to share these lessons confidently with your little ones as they grow.

Showing your kids what to do with money early on, rather than letting them learn the hard way, is a gift. (Perfection isn’t the aim, but knowing our responsibility here can be a great motivator for sticking to your money goals).

What are the benefits of having a simple budget?

When we started our simple budget journey, it was shocking to see where our money was really going during the newborn stage. Our biggest money ‘wastes’? Takeaway meals and not shopping around for better deals on our providers.

For example, by switching banks, we reduced our home loan interest rate by 1.5% – a rate our previous bank couldn’t match. And while I don’t regret buying takeaway to get us through those early days, in hindsight, I’d have spent less and put some of that money into savings.

By being more intentional, we redirected money to things that mattered to us more than takeaway – like booking a cruise to spend time with extended family and giving back to our community in small ways. The benefits didn’t stop there:

- Feel less stressed: Knowing where your money is going removes that constant low level worry every time you spend.

- Buy with cash: Save for what you need instead of relying on debt or Buy Now, Pay Later loans.

- Share the load: Budgeting as a team makes it less overwhelming and helps you set and achieve goals together.

- Set your kids up for success: The lessons you learn now can help your kids grow up confident with money.

How can you understand your spending?

The first step to creating a simple budget is understanding where your money is going. Look back at your spending over the past 1-3 months. I know this can feel daunting (I avoided it for a year after our baby was born!), but once you start, it’s such a relief.

Here are some methods to try:

- Pen and paper: Simple but time-consuming if you have lots of transactions.

- Budgeting app: Convenient but sometimes inaccurate, as it may miscategorise spending.

- Spreadsheet: Sounds boring but it’s my favourite, it’s fast, accurate, and easy to organise.

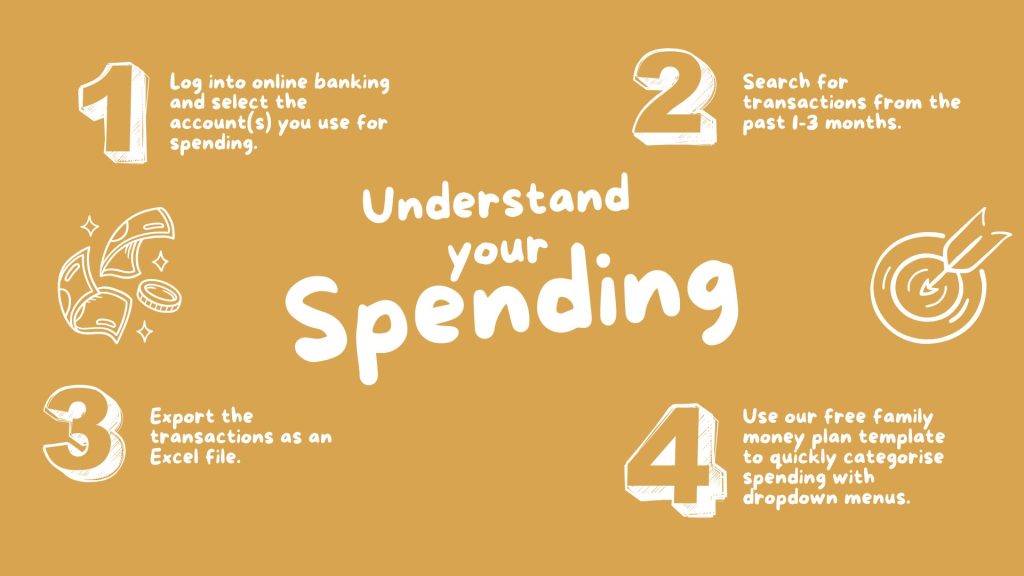

How to do it:

- Log into your online banking.

- Select the account(s) you use for spending.

- Search for transactions from the past 1-3 months.

- Export the transactions as an Excel file.

- Use our free family money plan template (access it via our homepage) to quickly categorise spending with dropdown menus.

Note: Don’t worry, you don’t have to do this every month. This is about creating a benchmark to set realistic money goals and build your simple budget. In future posts, we’ll show you how to automate tracking your spending in real time, it’s a game changer!

How can dreamlining help you set simple budget goals?

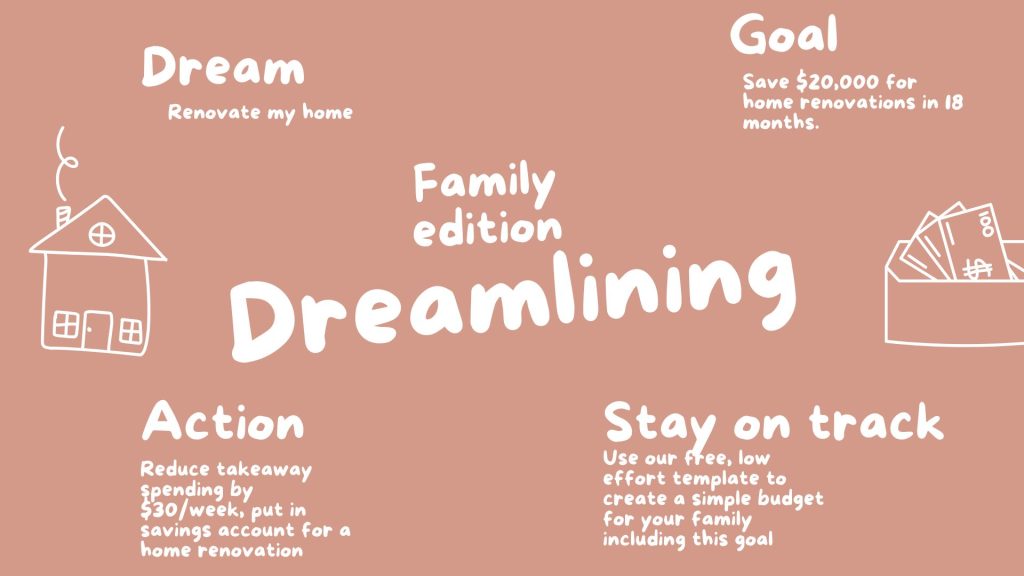

Once you know where your money is going, use that insight to set family financial goals. There’s a concept called dreamlining that helps turn your dreams into actionable steps. We’ve simplified it into a family friendly version.

What dreams do you have?

Start big! These can be things you want to have, who you want to be, or what you want to do.

- Have: Buy your first home or renovate your current one.

- Be: A family that travels regularly.

- Do: Enjoy regular date nights.

This is probably the most important part of all this: check your heart. How will you really feel after accomplishing that dream? Is it really worth the investment? Is there another way to achieve the desired outcome for less money? Is there another way to look at your current situation?

What small but meaningful goals can you set?

Break your dreams into actionable goals.

For example:

- Have: Save $20,000 for home renovations in 18 months.

- Be: Allocate $5,000/year for travel.

- Do: Budget $150/month for date nights ($2,700 over 18 months).

How do you focus on what’s achievable?

Hopefully it seems less than you thought to reach your priorities (e.g. thousands, rather than a few hundred thousand) but it can still feel daunting if you’re starting from zero. Breaking it down makes it manageable. Start small:

- Reduce takeaway spending by $30/week.

- Save $10/week toward each goal (home renovations, travel, and date nights).

This is where understanding your current spending becomes invaluable, it helps you spot the easiest areas to cut back (like takeaway in this example). You may also have credit card debt or similar repayments, generally speaking, tackling those first should be your priority.

How do you make a money plan that works?

Now that you’ve clarified your spending and set goals, it’s time to create a money plan that bridges the gap.

Our free, low effort family money map template makes this process quick and simple. Here’s how to use it:

- Get the template: Access it via our homepage.

- Make a copy: Open it in Google Drive (or download) and save your version.

- Clarify spending: Use the template to categorise your transactions.

- Follow the guide: Set up your simple budget with step by step instructions.

How can you make your simple budget sustainable?

A budget doesn’t have to be rigid. Build in flexibility, like a “fun money” category or small splurges, to keep it realistic. For example, set aside $20/week for spontaneous or personal purchases. Sometimes the word budget isn’t the most motivating so find a way to approach this that works for you.

What’s next?

Once you’ve created a simple budget, the next step is optimising your accounts for easier tracking. Stay tuned for tips on real time tracking and automating your simple budget.

Creating a simple budget helped us feel more excited about our family’s financial future – and I know it can help you too!

Question: What’s a money dream you have?