Family financial planning: How we kept spending in check & worked towards our money goals after baby (with 3 powerful actions to take this month)

Family financial planning is about creating a roadmap that aligns your values with your spending, helping you navigate life’s big changes, like becoming parents, while building stability and joy.

Table of Contents

When you’re preparing to welcome a baby, did you find it wasn’t unusual for friends, family, and even strangers to offer you well-meaning advice about money?

I remember hearing two things when I was expecting: “Don’t worry; having a baby isn’t that expensive,” and, “Don’t make any big life changes in the first year.” Looking back, we found the first piece of advice wasn’t true for us, and we didn’t follow the second one either.

The reality was that having a baby did stretch our budget. Our daughter’s frequent wake ups led us to explore potential health concerns, which quickly added up financially. On top of that, we went into survival mode to navigate the sleepless nights and steep learning curve of parenting. This meant spending on takeaway meals, activities to keep her entertained, and cafe visits to connect with my mothers’ group. Our priorities shifted, and so did the way we spent money and approached our financial planning.

We also made a huge life decision during that first year: we bought our first home. It didn’t align with the advice to avoid big changes, but it was the right decision for us, given the lack of rentals in our area and extremely high demand during 2020 lockdown.

Managing our finances while adjusting to these changes was a challenge. Seeking help from a financial counsellor, we created a budget that aligned with our lifestyle. This helped us ease into our new financial reality with less stress.

Parenthood changes everything, including how you approach money and financial planning. Even if you’re usually on top of your budget, big life changes like having a baby often require adjustments – and ideally, these adjustments are made ahead of time.

What does financial freedom mean for families?

The idea of “financial freedom” can feel out of reach for many families, especially if it’s tied to the concept of extreme wealth. For most of us, financial freedom might simply mean having enough to support our family, reduce financial stress, and enjoy time together.

So it’s often not really about becoming wealthy but about making intentional choices that create a fulfilling family life. Financial planning and setting achievable goals, like building an emergency fund, reducing debt, or saving for family adventures, can bring a sense of freedom without needing to chase unattainable ambitions.

So, how can you start moving towards financial planning for your family? Let’s begin by exploring a powerful mindset shift.

Reframing money: From currency to ‘life energy’

One of the most impactful lessons we learned was viewing money as “life energy,” a concept shared in the book Your Money or Your Life by Viki Robin and Joe Dominguez. This perspective suggests that every dollar you spend represents your time and energy – resources you can’t get back.

For us parents, this can be especially powerful. By asking, “Is this expense worth the time it took to earn this money?” you can reflect on your family’s true needs and values when financial planning.

This approach isn’t about guilt but about aligning your spending with what genuinely brings joy and value to your life. For example:

- Family activities like a zoo membership or an aquarium visit might feel worth the cost because they create cherished memories.

- Takeaways might not be worth the high cost of your time invested, so instead you opt for easy to assemble meals from the supermarket.

- Time saving purchases like a robot vacuum might be worth it if they free up time for rest or quality family moments.

Viewing money as life energy helps transform financial planning and decision making from a chore into a positive, purposeful activity. It allows you to direct resources toward what genuinely matters, whether that’s planning for future needs, creating meaningful experiences, or simply ensuring your spending aligns with your values.

How to start family financial planning

Here are three practical steps, or “love actions,” to help you begin or build on your financial planning journey.

loveaction 1. clarify your spending

The first step in family financial planning is understanding where your money is going. Review your bank statements or use a budgeting app to track your spending over the last 1-3 months. Categorise expenses (e.g., groceries, utilities, entertainment) to see how your money is being allocated.

This step can feel intimidating, but often quickly brings a sense of relief – it’s empowering to clearly see where you’re doing well and where there’s room for improvement.

Ask yourself:

- Which purchases brought joy or were truly needed for our family’s wellbeing?

- Which expenses could we cut back to support our financial goals?

This isn’t about guilt but about finding opportunities to align your spending with what matters most.

love action 2. dreamlining for families

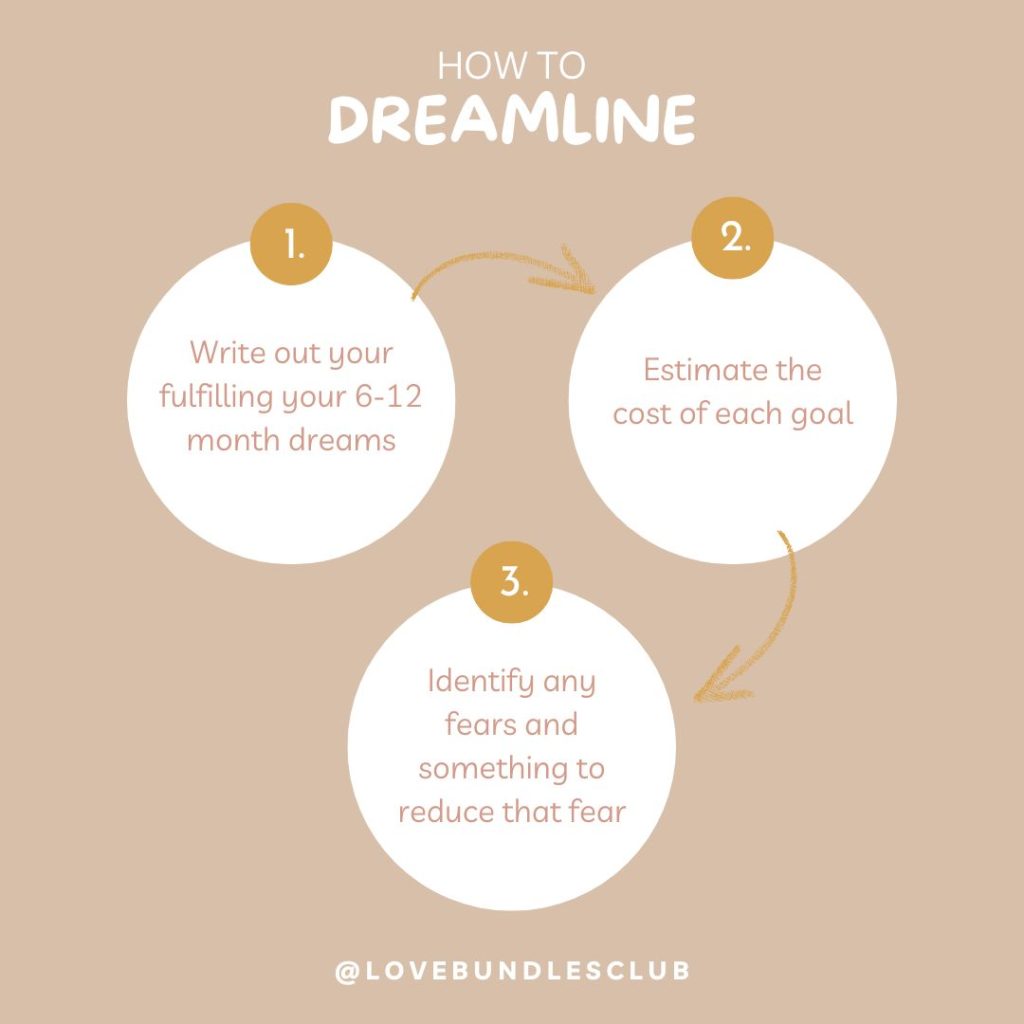

Dreamlining, as described in Tim Ferriss’ The 4-Hour Workweek, is all about imagining your ideal lifestyle or dreams and figuring out their actual cost. Often, the things we dream about don’t cost as much as we think, especially when broken down into manageable fortnightly or monthly goals.

You can incorporate this approach into your financial planning by listing 1-3 things you’d like to have, be, or do with your family in the next year. For example:

- Have: A family holiday, a backyard makeover, or an emergency savings fund.

- Be: More relaxed about money, debt-free, or better at saving.

- Do: Go camping, plan monthly family outings, or invest in family experiences.

Once you’ve identified your dreams, estimate the cost for each goal. For example, a backyard makeover might cost $5,000, which translates to saving around $417 per month for a year. Breaking it down like this can make even big dreams feel achievable.

Alongside this, take a moment to think about any fears holding you back. If you’re dreaming of starting a side hustle but fear the financial implications if it doesn’t succeed, consider creating a safety net first – such as saving three months worth of income in an emergency fund. This can give you the confidence to pursue your goals without undue stress.

Note: Here’s an important question to ask yourself as you dive into this – will this dream truly bring me joy? We often think the grass is greener on the other side of a renovation, holiday or career milestones. Consider also that our joy isn’t dependant on our circumstances, it comes from what we choose to dwell on. So while you may dream big, it’s also okay to dream small – a backyard camp out, regular Sunday pancake breakfasts, or a few hours of quality time without distractions can bring just as much joy as the big ticket items.

love action 3. make a family financial plan

With a clear understanding of your spending and your goals, it’s time to create a family money plan. Focus on small, achievable steps rather than a complete overhaul.

Some ideas to get you closer to your goals:

- Cut back on non-essentials (e.g., takeaway meals) and redirect that money to savings.

- Pay off debt with a targeted plan.

- Save for family experiences by setting aside a regular amount.

- Invest in the future through superannuation or an investment account.

The ‘guideline’ in the financial world is to aim for 50-60% of your income towards essentials, 30% towards non-essentials, and 10-20% towards future investments. Adjust these percentages based on your situation and check in regularly to stay on track.

Available for you now: our free, low effort family money map template to win back time and energy from your life admin.

If you’re feeling overwhelmed, seeing a free financial counsellor (or similar service in your country) who can provide tailored advice and financial planning, available to anyone who wants to see them.

Wrapping it up: a family approach to financial planning

Planning family financial goals doesn’t have to be about chasing wealth. It’s about making thoughtful, intentional choices that reduce stress, prioritise what matters, and help you enjoy life together.

Key takeaways:

- Financial freedom for families is about reducing stress, not chasing wealth.

- Viewing money as life energy can help you spend more intentionally.

- Small, consistent steps towards family financial goals can make a big difference over time.

love actions:

- Clarify your spending: Track and categorise your expenses.

- Dreamlining: Define specific goals for the next 6-12 months.

- Make a family money plan: Direct funds to not only your essentials, but your goals (even if it’s $5 a week).

In this post, we provide a step by step guide to these actions.

By redefining financial freedom to fit your family’s needs, you can create a financial plan that supports your values, reduces financial stress, and sets your family up for a fulfilling future.

Question: What’s a money skill each of you already have? (trust me, everybody has something they do on autopilot and don’t even realise!)